-

Training Catalog 2024-Present+Online

-

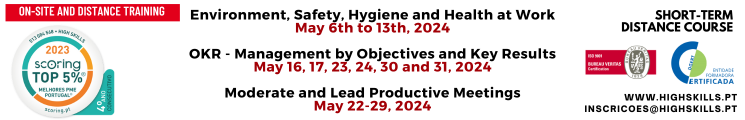

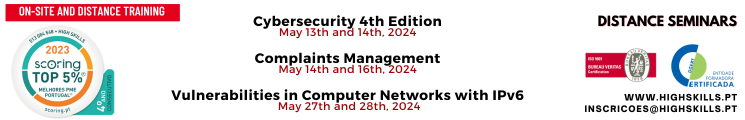

Training Calendar from April to June 2024

-

Seminar on 5S Methodology 6th Edition (via Online), May 02 and 09, 2024

-

ESG Seminar - Sustainability in Management and Business 2nd Edition via Online, May 3rd and 10th, 2024

-

Mini MBA Specialization in Human Resources Management with the Excel Tool applied to HR (via Online), May 06 to 22, 2024

-

Short Course in Public Administration Recruitment (via Online), May 10-17, 2024

-

Cybersecurity Seminar 4th Edition via Online, May 13th and 14th, 2024

-

Master in Governance, Risk and Compliance 6th Edition via Online, May 13-24, 2024

-

OKR Short Course - Management by Objectives and Key Results (via Online), May 16, 17, 23, 24, 30 and 31, 2024

-

Master in Procurement, Logistics and Stock Management 3rd Edition via Online, May 16, 17, 23, 24, 30 and 31 and June 06 and 07, 2024